By: Seraphina Quinn

In the high-stakes world of mergers and acquisitions, where only one in five deals survive due diligence, AMIVA+ appears as a game-changing solution. This innovative platform aims to transform the challenging landscape of M&A, addressing long-standing inefficiencies in an industry that handles $5 trillion in annual deals.

A Vision Born from Experience

Mike Pantouvakis, co-founder and CEO of AMIVA+, brings real-world expertise to the table. “As a managing principal at a boutique sell-side M&A advisory, I was constantly juggling multiple tools, leading to inefficiencies and high costs,” explains Pantouvakis. “There came a point where I was fed up with the inconsistency and the costs—both time and money—of switching between platforms. That’s when I envisioned an ultimate solution living at the intersection of a marketplace, workflow tool, and communications portal. The goal has always been to create a singular place for dealmakers to conduct business without the back-office headaches.”

More Than Just a Tool: A Comprehensive Ecosystem

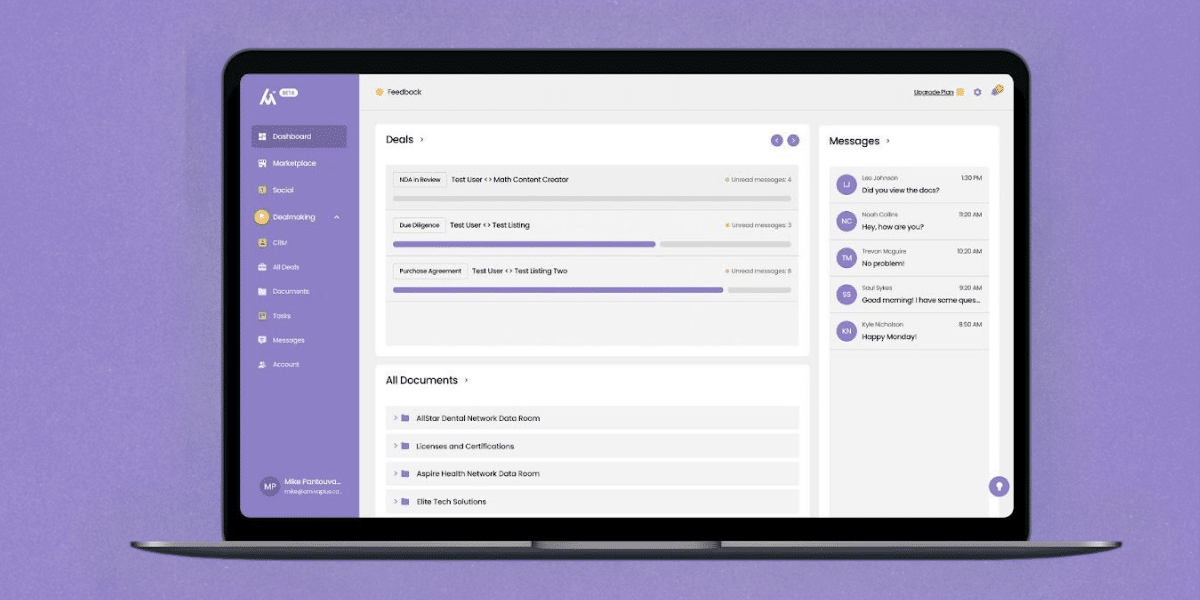

AMIVA+ isn’t just another addition to the crowded field of M&A software. It’s a category-defining cloud-based solution called Streamlined Deal Portal (SDP). This all-in-one ecosystem seamlessly blends marketplace functionality, CRM, and professional networking into a single, powerful platform.

Key features of AMIVA+ include:

– Integrated communication tools

– Secure digital data rooms

– Digital task management

– Robust marketplace for deal discovery and assessment

– E-sign capabilities

– Automated CRM

– Professional networking

By bringing these critical functions together, AMIVA+ allows dealmakers to seamlessly close deals through one central ecosystem, potentially boosting M&A success rates by 20% and unlocking $1 trillion in new value.

Efficiency and Cost-Effectiveness

While traditional M&A software solutions typically cost around $1,800 per month and consume about 115 hours of usage, AMIVA+ offers a more wallet-friendly alternative at $250 per month. Moreover, it saves users dozens of hours every month by consolidating all necessary software functions under one roof.

“Our mission is simple: save dealmakers time and money,” Pantouvakis explains. “By bringing all necessary software functions under one roof, we’re not just boosting efficiency – we’re also significantly cutting costs.”

Expertise-Driven Development

AMIVA+ is helmed by a core founding team of four talented individuals. Mike Pantouvakis, the CEO, brings his extensive experience from AMIVA Equity Partners, having overseen hundreds of millions in deal flow. Will Sooter, the CTO, is the genius behind the platform’s development and brings a wealth of development experience from other successful startups. Yingyang Zhang, the Head of UI, is the brilliant mind ensuring an intuitive user experience. Lastly, Hamaad Jafry, a sales and operations expert from a top asset management firm.

Building the technology from the ground up was one of the biggest challenges, given that nothing similar existed in the market. However, the team, led by their skilled CTO and supported by an exceptional UI designer, managed to bring the vision to life.

With that also comes a board of advisors with over 125 years of combined experience and more than $ billion in successful transactions. This dream team includes M&A heavyweights like Bill Hunscher, tech innovators like Rezzan Kose, legal experts like Emiliano Baidenbaum, and software veterans like Greg Pesik. Rounding out this powerhouse team are Phil Moretinni, a seasoned tech executive with a track record of success in marketing, sales, and product management; Keeano Martin, an innovative thinker who thrives on turning complex technological challenges into reality; and Josh Carney, a prolific entrepreneur who has built several of the world’s largest financial education brands, driving over $ million in revenue. Their collective expertise ensures that AMIVA+ is built on a foundation of industry knowledge and best practices.

Real-World Impact

The impact of AMIVA+ is already evident. Users report receiving indications of interest (IOIs) twice as frequently when using the platform, significantly reducing workload thanks to its automations. This increase in efficiency showcases the tangible benefits of integrating AMIVA+ into the M&A process.

Leading the Digital Shift in M&A

As the M&A landscape increasingly shifts towards digital integration, with over 80% of deals now conducted asynchronously using technology, AMIVA+ is well-positioned to lead the way.

“We’re not just building a platform; we’re shaping the future of M&A,” Pantouvakis notes. “AMIVA+ is poised to become the go-to digital navigator for dealmakers worldwide.”

By tackling long-standing inefficiencies, leveraging cutting-edge technology, and tapping into the expertise of industry veterans, AMIVA+ promises to revolutionize how M&A deals are discovered, managed, and closed. As the industry continues to evolve, tools like AMIVA+ may become essential for staying ahead in the world of mergers and acquisitions.

Published by: Nelly Chavez