By: Tom White

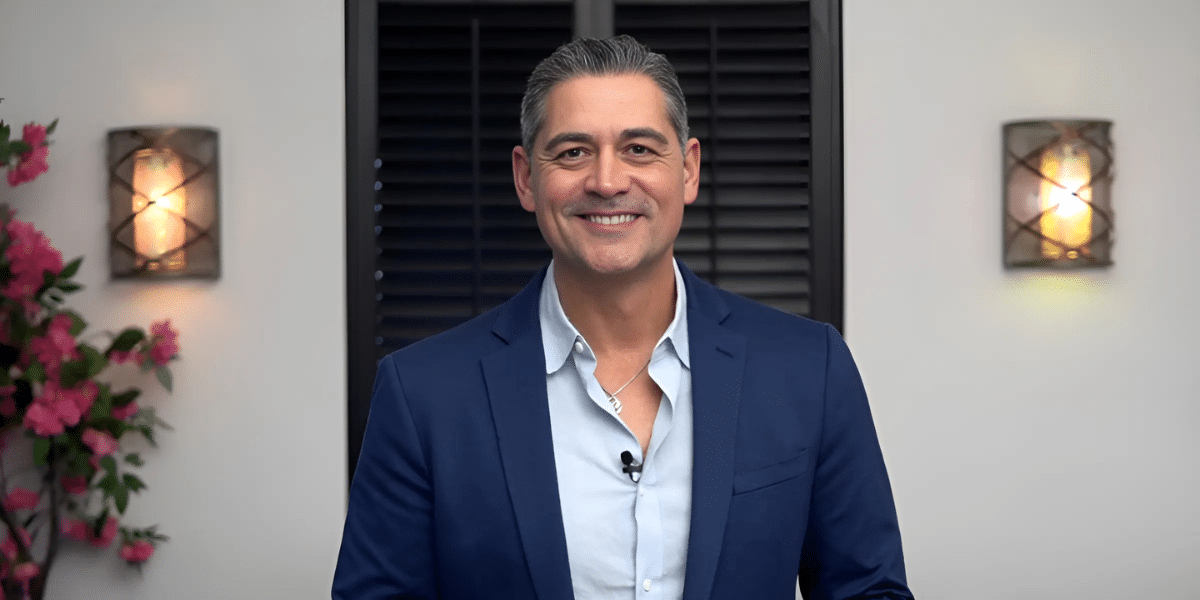

It’s extraordinary when one takes the lessons from their experiences, particularly those characterized by hardship, and turns them into a mission to create lasting change. After all, such determination requires vision, empathy, and a willingness to tackle systemic issues. Wacinque Amistad Kaizen BeMende possesses these qualities. He has dedicated his life to addressing one persistent yet surprisingly overlooked challenge: the exclusion of millions from financial systems.

As the founder and Chief Abundance Consultant of KaizenRhino Solutions International (KSRI), BeMende aims to reduce the number of unbanked and underbanked individuals worldwide. This goal reflects his belief that no one must be left behind in achieving financial empowerment—a belief shaped by being raised in a family mired in generational poverty.

The visionary, growing up on government assistance, witnessed the crippling effects of financial instability. He recalls moments that solidified his resolve, such as overhearing adults discussing their financial struggles at church, which ignited his desire to escape poverty and help others do the same.

As if fate intended, BeMende’s teacher introduced him to the concept of compound interest. In high school, he delved into the stock market, learning to analyze market information from newspapers. Unknown to the then-young man, these early exposures would serve as the beginning of his journey in finance. Before establishing his presence in the field, however, he built a remarkable 40-year career in the military.

BeMende was enlisted in the Marine Corps in 1975. He served in various branches over the decades, including the Navy, Air Force, and the Coast Guard, retiring as a decorated service member in 2016. His military career took him around the world, exposing him to poverty on a global scale and deepening his understanding of economic disparity.

The passionate man, ever committed, ensured that he pursued an education in banking and finance while serving. He earned a degree in human services from Upper Iowa University and later taught personal finance as an adjunct instructor at Central Texas Community College. BeMende even volunteered extensively with programs focused on financial education, tax preparation, and debt management, serving unbanked and low-income families.

The seasoned professional’s hands-on work in communities and frustration with the slow progress of the traditional approach to poverty alleviation fueled his entrepreneurial spirit and motivation to pave a new, innovative path. All these circumstances led to BeMende developing one of his first initiatives: Establishing an Asset Ownership Standard, which addresses financial exclusion with the same urgency and precision as a scientific breakthrough.

The Kid’s Savings Program is another noteworthy project of his. It promoted financial literacy and encouraged early saving habits. Donating thousands of dollars to the Community Action of Laramie County in Cheyenne, Wyoming, BeMende kickstarted the Wacinque “Rhino” Fund Endowment. This program provided children with the means to open savings accounts, instilling financial responsibility at a young age.

Building on the successes of these initiatives and utilizing the insights he gained from years of community engagement, BeMende built KaizenRhino Solutions International L3C. The unique social enterprise integrates his earlier initiatives, including the Rhino Fund, into a broader framework that addresses financial exclusion and creates pathways to generational wealth. Here, he intends to create an Asset Ownership Standard (AOS). This framework, modeled after Bloomberg’s “wealth number,” aims to give everyone access to financial tools that enable compounding wealth regardless of their circumstances.

In addition to establishing an AOS, BeMende offers comprehensive products through KSRI. One is the Global Permanent Investment Account-Dividends® (GPIA-DIV), a financial tool that combines savings with dividend-paying stocks. The account offers additional income across generations, using the benefits of compounding to build long-term wealth. With these, it’s evident that KSRI reflects its founder’s ambitious yet noble goal of empowering individuals with access to a regulated platform. Through this initiative, he aims to encourage individuals to take control of self-directed, income-generating accounts, helping to break the cycle of poverty for future generations.

BeMende shares a personal anecdote that shaped his mission. “When I was a kid, my teachers, knowing I was a Gemini, used the Gemini space program to spark my interest in reading. It worked. I became fascinated with science, math, and the cosmos. What changed my life, though, was learning that we’re made of stardust—the same elements that form the universe. This inspired me to think about the building blocks of life and what it means to truly thrive,” he recalls. “Now, I see financial inclusion as critical as air and water—both essential elements of human survival. We need a universal financial system accessible to everyone. It should be a given, not a privilege, yet many are still locked out of basic financial systems.”

It’s worth highlighting that BeMende received the Wisconsin Governor’s Financial Literacy Award for his contributions to financial education, in 2018. The following year, he was selected as a participant in the US State Department’s Global Entrepreneurship Summit, which highlighted cutting-edge solutions with global impact.

Indeed, becoming a global advocate for financial inclusion is no easy feat. However, with the work of passionate visionaries like Wacinque A.K. BeMende, an abundant future where everyone has access to the tools and knowledge needed to build wealth is possible.

Disclaimer: This content is for general informational purposes only and should not be considered as financial advice. The content is not intended to be a substitute for professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by Zane L.