In this issue, hedge fund manager and founder of Olritz Financial Group, Sean Chin MQ, is covering the current USD market standing, China property market situation, commodities and major FX overview.

Sean Chin MQ is managing $150M AUM at his Hong Kong-based investment brokerage firm Olritz Financial Group. Sean Chin MQ has been investing for over a decade in international markets, including commodities and private equity. Sean manages high-net-worth private individual and institutional clients.

This special edition of Q4 2023 market insights is exclusively prepared by Sean Chin MQ. Sean offers market insights for his clients and financial market audience.

USD as a safe haven

Elevated interest rates and robust economic growth in the US relative to the rest of the world have broadly supported the US dollar over the past two months. While market pricing for the FED’s terminal rate has been relatively stable, the implied pricing for rate cuts next year fell after the Fed signaled that rates may stay higher for longer.

For instance, from a recent low in mid-July, the US dollar has appreciated by around 6% against the euro, with the dollar index, a basket of six major currencies, rising by a similar amount. The USD will stay well bid until the end of 2023 and move the US dollar to a neutral position.

Of the three currencies that held up well overnight, the USD benefitted as a safe haven of choice amidst the angst in risk appetite caused by the prospect of extended higher interest rates and the looming US government shutdown. By contrast, the CNY and SEK held on to greater support from the authorities. Despite concerns over the Chinese property downdraft, strong CNY fixings by the China Central Bank kept the currency stable while the SEK benefitted from Riksbank’s FX Hedging program.

In regards to the US government Shutdown, the Senate is working on a continuing resolution to keep the government open past 30 September. The House is in session until Friday, working to reach some compromise on a funding bill. It remains far from clear whether either effort will garner enough support to avert a government shutdown.

China property headwinds continue on

Shares in Chinese property developers remained volatile amid more negative headlines in the sector, with the Hang Seng mainland property index down 7.3% this week. Trade in China Evergrande and two units was suspended Thursday following a Bloomberg report the firm’s Chairman had been placed under police ‘residential surveillance’ earlier this month. China’s most indebted developer’s restructuring plans came under question this week amid regulatory blocks on new debt issuance. Earlier this week, developer China Oceanwide said a Bermuda court had ordered it to wind up. Country Garden is also in talks with advisors over restructuring its offshore debt. The Chinese central bank on Wednesday also pledged precise and forceful monetary policy support to promote a healthy property market through lower payment ratios and mortgage rates.

This week’s events underscore our view that investors should expect more volatility in China’s still-ailing property sector. However, we think China’s economy is headed for a gradual recovery as prior policy measures take effect. We maintain our target level of 17000 in the Hong Kong HSI market and will see whether a rebound buy takes place.

Commodities Brief

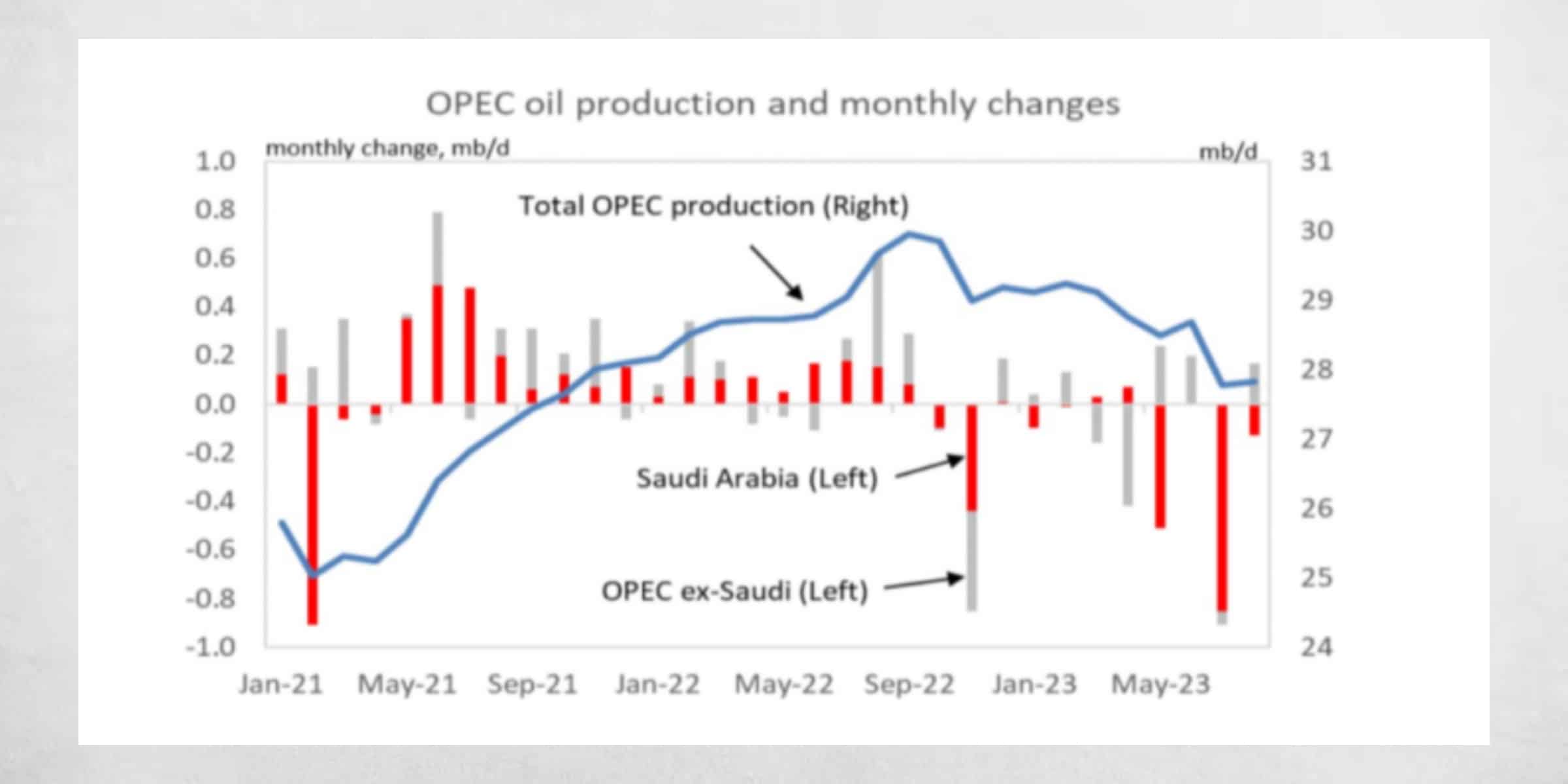

Crude Oil price supported by tighter supply

Crude inventories decline, pushing oil prices higher. Oil prices have extended gains over the past 24 hours after a fall in US crude inventories added to concerns over tight supply. Brent and WTI gained 2.8% and 3.6%, respectively, on Wednesday and have added more gains over the week. This followed Energy Information Administration (EIA) data showing crude oil inventories (excluding those within the Strategic Petroleum Reserve) were drawn down by an additional 2.2 million barrels compared to the week prior. Inventories are now 4% below the 5-year average.

This week, Saudi Arabia and Russia plan to announce what they intend to do with the voluntary supply cuts for next month, which are expected to remain in place until the end of the year. If prices keep ticking materially higher, a modest increase in production is possible. Conversely, should prices stay at current levels, unchanged production guidance is more likely. We forecast Brent Crude Oil to stay within a range of US 90-100/bbl.

Precious Metals

Gold futures prices fell to USD 1,868/oz while Emerging market FX carry trades faced more unwinding pressures as the US yields rose to a fresh multi-year high. Investors are adjusting to the anticipation that the Fed is unlikely to ease monetary policy next year. Rising yields are weighing on fund flows to Gold ETF, too. Renewed strength in the USD is another headwind for the precious metal, reducing the appetite for gold as a yielding investment. We remain positive on gold and silver prices over a 12-month horizon, though our expected rebound in prices is pushed forward sometime by late 1H24, given that the Fed will likely not be able to start cutting rates until at least June 2024.

Major FX Macro

CHF vs JPY

The Swiss National Bank’s (SNB) dovish pivot to keep the policy rate on hold this month reinforces the CHF as better funded than the JPY. While the SNB maintains its rate on hold, it’s looking more likely that its tolerance for a strong real exchange rate has greatly diminished, with the core inflation rate below 2% and the Swiss economy underperforming even the Eurozone. On the other hand, The current dovish Bank of Japan stance- which has driven the JPY weaker so far this year seems increasingly unsustainable amid further inflation acceleration. This momentum would come despite US-Japan 10-year yield differential widening to levels last seen in November last year.

Newsletter Disclaimer

This material does not provide individually tailored investment advice. This material has been prepared for and is intended for private circulation. The contents of this material do not take into account the specific investment objectives, investment experience, financial situation, or particular needs of any particular person. You should independently evaluate the contents of this material and consider the suitability of any product discussed in this material, taking into account your own specific investment objectives, investment experience, financial situation and particular needs. If in doubt about the contents of this material or the suitability of any product discussed in this material, you should obtain independent financial advice from your own financial or other professional advisers, taking into account your specific investment objectives, investment experience, financial situation and particular needs, before making a commitment to purchase any product.

This material is not and should not be construed as an offer or a solicitation to deal in any product or to enter into any legal relations. You should contact your own representative directly if you are interested in buying or selling any product discussed in this material.

The information or views contained in this material may have been discussed with others within or outside the Entity, and the entity may have already acted on the basis of such information or views (including communicating such information or views to other customers of the entity).