By: PR Fueled

The iSwiss Bank CEO shares his vision for attracting global investments and supporting growth across the continent.

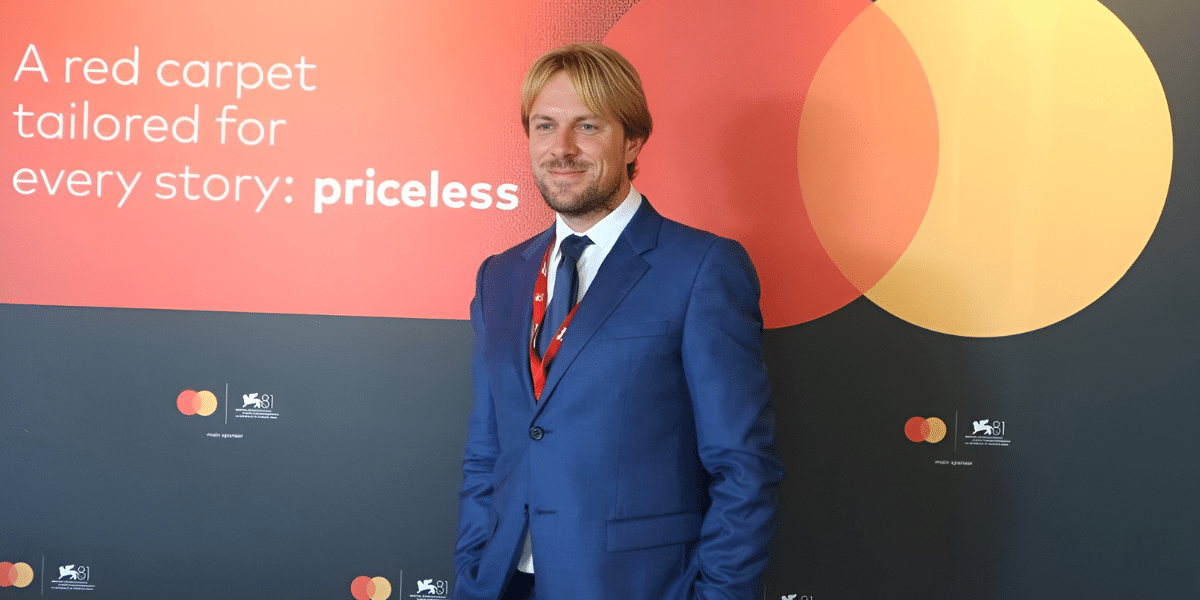

Christopher Aleo, thank you for this exclusive interview. We know that iSwiss Bank recently acquired the first license for a Free Economic Zone in Eswatini, a project that has garnered significant interest. Could you tell us how this ambitious initiative came to life?

CA – Thank you for the opportunity. The Free Economic Zone in Eswatini is the result of a strategic vision. We identified extraordinary growth potential in this African country. Eswatini is a young, ambitious nation aiming to diversify its economy and become a major attraction for international businesses. Having worked closely with various royal families in the Middle East and seen firsthand how Dubai and Qatar transformed their economies through free zones, we wanted to bring that same forward-thinking approach to Eswatini.

What does this Free Zone offer companies compared to similar setups worldwide?

CA – We designed Eswatini’s Free Zone to be highly competitive, offering corporate tax rates to attract companies worldwide. Beyond the tax benefits, we’re allowing companies to establish themselves in minutes, complete with an active multi-currency bank account. We aim to eliminate bureaucracy and streamline processes using advanced technologies, such as facial recognition for ID verification and document checks. Additionally, we’re working to build a globally connected banking infrastructure so that companies can transfer money as easily as they conduct a local transaction.

Which sectors are you primarily targeting in Eswatini?

CA – We’re not limiting ourselves to financial services. The Free Zone will be a hub for strategic sectors like renewable energy, tourism, and natural resources. Eswatini is rich in natural resources and has great potential to become a hotspot for African tourism. Additionally, we’re expanding our investments in agriculture and infrastructure. This broad approach may positively impact the local population and potentially create new employment opportunities.

Your career has been marked by impressive success in a short amount of time. What’s your vision for iSwiss Bank and its future?

CA – My vision for iSwiss is to establish it as a global institution that drives international financial innovation. I’ve always believed that success lies in the ability to adapt and understand the needs of our clients, whether they’re large corporations or small businesses. I aim to keep iSwiss growing and introduce new tools and platforms that simplify how companies interact with finance. Additionally, we’re working closely with global regulations to ensure security and reliability, which, to me, is essential.

You’ve worked closely with some of the influential royal families in the Middle East. What have you learned from these experiences?

CA – I was fortunate to learn a lot from the Middle East, where royal families have managed to transform their countries into global benchmarks. Their strategic vision is incredible: they look to the long term and invest in human capital and infrastructure in an exemplary way. This experience taught me the importance of being forward-thinking, working not just for the present but for future generations, and this is what I aim to replicate in Eswatini.

From what you’ve shared, it sounds like iSwiss places a strong emphasis on supporting small and medium enterprises. What are you doing for them?

CA – Absolutely, we’re very focused on supporting SMEs, which are a vital part of the global economy. Financial instruments such as securitization can help SMEs access capital with fewer complications than those often found in traditional banking. We’re building a platform that enables small businesses to access global markets, not only for funding but also for international transactions. This is an area I’m deeply committed to and where we’re striving to make a significant difference.

We understand that iSwiss has plans to expand into many more countries. What’s your strategy for the future?

CA – Our strategy is simple yet ambitious: we want to bring iSwiss to markets with strong growth potential that could benefit from our financial solutions. Eswatini is just the beginning; we have plans to expand further into Africa, as well as into Eastern Europe and Asia. We’re also working on obtaining new financial licenses that will allow us to offer our services in other countries, always with a focus on technology and customer simplicity.

One last question: if you had to describe iSwiss in three words, what would they be?

CA – I would say innovation, accessibility, and vision. These are the three pillars that guide every decision we make and push us to improve continually.

Thank you for your time, Dr. Aleo. We wish you immense success with the Free Zone in Eswatini and all your future projects.

CA – Thank you. It’s always a pleasure to share our vision with those who understand the value of innovating and supporting the global economy.

Disclaimer: This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.

Published by: Martin De Juan