In recent years, there has been a noticeable shift towards cashless payments, with more and more people opting to use digital payment methods instead of traditional cash. But what exactly is driving this trend, and why are so many individuals embracing cashless transactions? Let’s delve into the reasons behind the growing popularity of cashless payments.

Convenience and Accessibility

One of the primary reasons why people are going cashless is the convenience and accessibility offered by digital payment methods. With just a few taps on their smartphones or swipes of their cards, individuals can make payments quickly and easily, without the need to carry around bulky wallets or worry about carrying exact change. Whether it’s paying for groceries at the supermarket, splitting the bill at a restaurant, or ordering goods online, cashless payments offer unparalleled convenience for consumers.

Safety and Security

Another key factor driving the shift towards cashless payments is the enhanced safety and security they provide. Unlike cash, which can be lost or stolen, digital payments offer built-in security features such as encryption, authentication, and fraud detection measures. This gives consumers peace of mind knowing that their money is safe and protected, even in the event of theft or loss. Additionally, digital payment platforms often offer features like transaction alerts and biometric authentication, further enhancing security and reducing the risk of unauthorized transactions.

Contactless Payments

The COVID-19 pandemic has accelerated the adoption of contactless payments, as people seek ways to minimize physical contact and reduce the spread of germs. Contactless payment methods, such as tap-to-pay cards and mobile wallets, allow users to make transactions without the need to physically swipe or insert their cards into payment terminals. This not only reduces the risk of spreading infectious diseases but also provides a faster and more convenient payment experience for consumers.

Rewards and Incentives

Many digital payment platforms offer rewards and incentives to encourage users to go cashless. Cashback rewards, loyalty points, discounts, and exclusive offers are just some of the perks that consumers can enjoy when using digital payment methods. These incentives not only incentivize consumers to use cashless payments but also help drive customer loyalty and engagement with payment providers and merchants.

Budgeting and Tracking Expenses

Digital payment methods offer consumers greater visibility and control over their finances, making it easier to budget and track expenses. With features like real-time transaction notifications, spending analytics, and budgeting tools, users can easily monitor their spending habits, identify areas where they can save money, and make more informed financial decisions. This level of transparency and accountability is particularly appealing to millennials and Gen Z consumers, who value financial literacy and control over their finances.

Environmental Impact

Going cashless can also have a positive environmental impact by reducing the need for paper currency, which is produced using valuable natural resources and contributes to deforestation and pollution. Digital payments eliminate the need for paper-based transactions, leading to less waste and carbon emissions associated with printing, transporting, and disposing of cash. Additionally, digital receipts and electronic statements further reduce paper usage and help conserve resources.

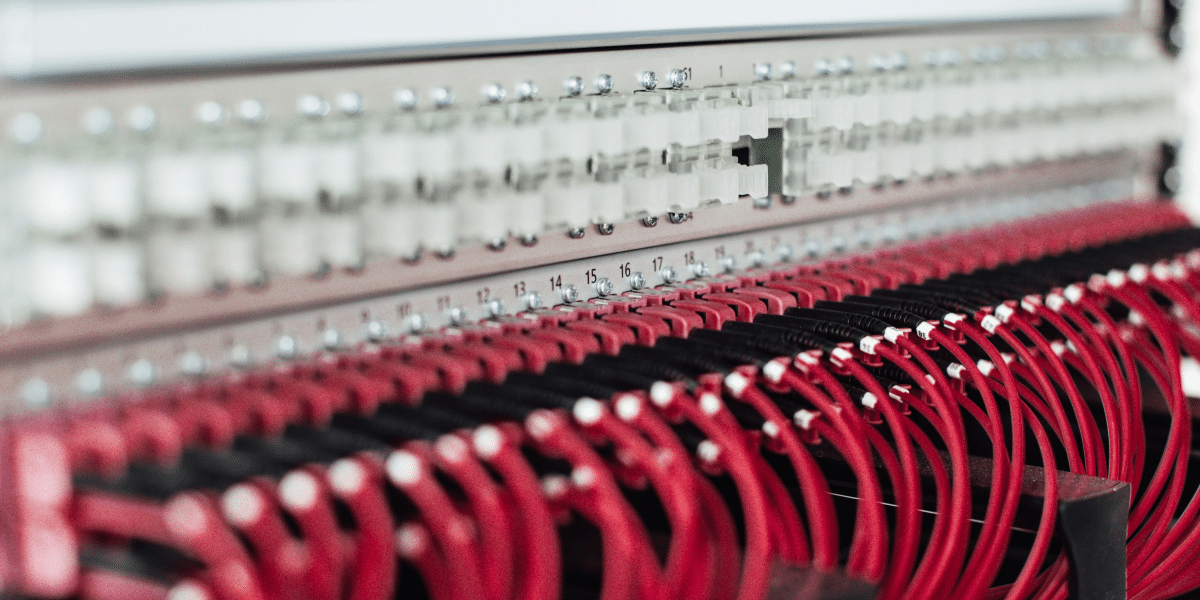

Integration with Digital Ecosystems

The rise of cashless payments is closely tied to the proliferation of digital ecosystems and platforms that offer a seamless and interconnected experience for consumers. From e-commerce marketplaces and food delivery apps to ride-sharing services and streaming platforms, digital payment methods have become integral to the functioning of these ecosystems, enabling frictionless transactions and enhancing the overall user experience. As these digital ecosystems continue to expand and evolve, cashless payments are expected to become even more pervasive and ingrained in everyday life.

Plenty of Benefits in Going Cashless

In conclusion, the shift towards cashless payments is driven by a combination of factors, including convenience, safety, contactless technology, rewards, budgeting tools, environmental considerations, and integration with digital ecosystems. As technology continues to advance and consumer preferences evolve, cashless payments are expected to become increasingly prevalent, reshaping the way we transact and interact with money in the digital age. Whether it’s paying for goods and services, sending money to friends and family, or managing finances, cashless payments offer a convenient, secure, and efficient alternative to traditional cash transactions.